Bad Credit Financing Things To Know Before You Buy

An individual financing can be a cheaper means to obtain contrasted to a credit history card or payday advance. In each instance, the expense of loaning can establish whether an individual lending makes good sense. With a high-interest personal car loan, combining might not deserve it if the funding doesn't really provide any savings.

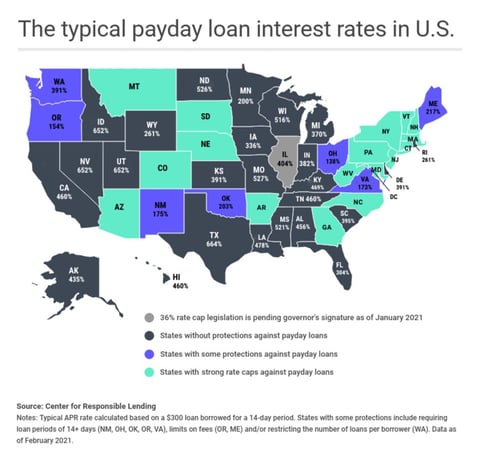

A payday loan provider will not necessarily perform a credit report contact the significant credit history bureaus when you apply for a lending. While that might make it simpler to get a payday advance when you have poor debt, the high price might make it difficult to pay back. High-cost payday lending is banned in some states.

Some Of Bad Credit Financing

If you're denied credit history because of info in your credit scores records, you ought to get what's called an unfavorable activity notification from the lender, offering you a description. This can help you recognize why you were refuted and influence you to comb via your credit report records and also see where your credit rating stands.

Below are a couple of lending kinds to take into consideration if you have bad credit report. Some individual car loan lending institutions use installment loans to individuals with bad credit score. If you certify, you'll likely pay greater passion prices than a person with excellent credit history yet it'll possibly still be much less than you would certainly pay with a cash advance financing.

Getting The Bad Credit Financing To Work

A normal payday advance loan might have an APR of 400%, as well as the brief payment timeline usually catches debtors in a cycle of debt that's challenging to escape. When we looked for the ideal individual lendings for negative credit report we considered variables such as convenience of the car loan application procedure, rates of interest, fees, car loan amounts offered, finance terms and lending institution transparency.

If this appears like something you 'd have an interest in finding out more regarding, then take a moment to review our review of the ideal installment loans for poor debt. Low credit history candidates approved Cash in as little as 24-hour Huge network of lending institutions Registered OLA participant High quality option of educational resources $5,000 max financing quantity Not offered in all states Established in 2010, Cash, Mutual is an on the internet borrowing marketplace that specializes in installment financings, individual car loans, as well as brief term cash loan - bad credit financing.

Getting The Bad Credit Financing To Work

To make use of the solution, simply finish an application, go into the preferred loan quantity, as well as allow Money, Shared work its magic. bad credit financing. In some situations, Cash, Mutual can have a loan accepted and cash in your account in as little as 24 hours. What's more, the company works with numerous loan providers ready to approve unsafe individual finances for applicants with a credit rating of 600 or much less.

Moreover, the company is a recognized participant of the Online Lenders Alliance - a company devoted to securing customers as well as describing requirements and ideal methods for online lenders. To utilize Cash, Mutual, applicants need to have a minimum monthly income of $800 and be 18 years of age or older. Some lending institutions in the network even accept social protection, handicap, as well as other kinds of benefits as certifying income - making it a terrific selection for elders or professionals.

The Definitive Guide to Bad Credit Financing

If you have actually located on your own knee-deep in bank card debt and have an okay to reasonable credit report, combining your debt by means of an individual car loan deserves some major factor to consider. Interested? If so, know that Cash, United States processes financing applications of, making them a great prospect for the work.

$10,000 $500 5. 99% - 35. see this page 99% (varies by lending institution and credit report) Poor credit fundings as much as $10,000 Credit report cards offered No minimum credit history demand No minimum regular monthly earnings demand High approval ranking Vehicle, home, and pupil finances available Interest prices can be high on some loans Not available in all states As the name implies, concentrates on offering inadequate credit rating borrowers with rapid access to cash when they require it most.

Bad Credit Financing Can Be Fun For Anyone

One essential attribute that separates the attire from other lending networks is its inclusion of peer-2-peer loan providers. Peer-2-peer lendings are various from regular installment financings because they're given by people, and not loaning organizations. As a result of this, rates of interest on peer-2-peer finances typically feature reduced rate of interest as well as greater approval prices.

The Greatest Guide To Bad Credit Financing

This implies all loans must be repaid in one installation and not equal monthly payments. That claimed, payday finances included much higher rates of interest than installment fundings and also array from 235% to 1304%. While this is no doubt a drawback, they come to all lending institutions no matter their credit score.

Some lenders also supply term lengths of approximately 72 months, which depending upon the pop over to this site rate of interest, can leave you with economical regular monthly repayments. Certainly, just applicants with an appropriate credit report history imp source will certainly receive the. Still, 247Credit, Currently will certainly process, which come to applicants with credit report scores as reduced as 580.

Fascination About Bad Credit Financing

The prices vary as well as are determined by each loan provider. Your financing terms depend on the type of financing you accept. Payday car loans are typically due on your next pay date. Other financing terms range from 6 to 72 months. Of all companies providing same day loans for bad credit score, an excellent section of them are dubious as well as predative - using rates of interest as well as origination charges well-above sector criterion.

If you're in a pinch, you don't intend to wait up to 5 organization days for a response. Due to this, all lending networks consisted of in our checklist can have a financing accepted as well as processed in just 24 hr! Negative credit report installation lendings will constantly feature higher than average rates of interest - it's unavoidable.

Facts About Bad Credit Financing Revealed

Everyone's scenario is various. While some call for just a couple of hundred dollars, others may require access to several thousand. With this in mind, our list of loaning networks includes choices for car loans as low as $100 and as high as $35,000. Yes, all installation funding lenders will certainly run a credit report check prior to approving a loan.

The Basic Principles Of Bad Credit Financing

By contrast, open-ended credit scores items - like credit scores cards or credit lines - allow the customer to utilize as much, or as little, of their extended credit as they like. Flexible lending products have no defined payment period, as well as rather, the debtor needs to make a minimum of the minimal month-to-month repayment to keep the account in great standing.

Comments on “The Basic Principles Of Bad Credit Financing”